Unpacking the Potential of 2024

As we enter 2024, it’s imperative to shift our focus from holiday relaxation to solidifying our financial futures.

A common barrier many face is procrastination. The return to everyday life often sidelines financial planning, but remember, hesitation can be expensive.

In 2023, those who delayed action missed out on considerable capital growth, often in excess of $50,000. With the opportunities that 2024 presents, overcoming procrastination is key to financial success.

Continuing Momentum in the Property Market

2023 was a year where Australian property prices demonstrated remarkable resilience.

Despite rising interest rates, the market exceeded expectations with an 8.1% increase in home values.

This growth was fuelled by a blend of factors including limited supply, increased immigration, wage growth, low vacancy rates, and higher rental yields.

Predictions suggest this upward trend will persist in 2024, buoyed by these continued influences.

The Game-Changing Prospect for 2024

The Australian property market has been robust, yet high-interest rates have posed significant barriers.

However, a potential decrease in interest rates could alter this landscape.

Last year, despite the challenge of high rates, property prices still rose by 8.1% nationally. A reduction in rates could further accelerate this growth.

Interest Rate Predictions by Major Banks

The Commonwealth Bank has projected a significant decrease in interest rates by the Reserve Bank of Australia, anticipating a drop of 0.75% from September 2024. This could bring the rates down from 4.35% to 3.6% by the end of 2024, with further reductions anticipated in 2025.

Evaluating the Impact on Property Growth

Property markets operate on supply and demand principles. Lower interest rates make property investments more accessible, boosting demand and, consequently, prices. This scenario, combined with the current supply constraints, positions the market for potential growth.

Insights into Household Savings

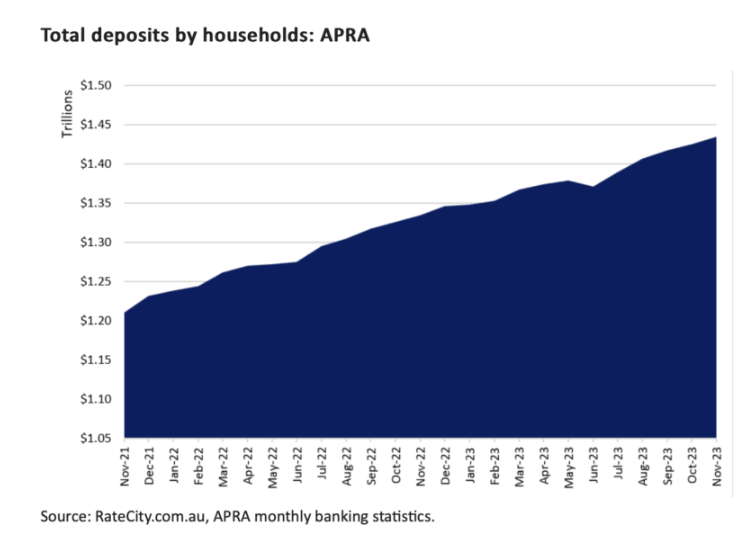

Record Highs in Household Deposits

Recent months have seen Australians accumulating significant savings, with deposits growing by over $10 billion in just one month.

This trend is akin to the savings behaviour observed during the pandemic, which fuelled a historic property boom. The latest data from APRA shows this trend continuing, with an additional $10.5 billion in savings recorded in November.

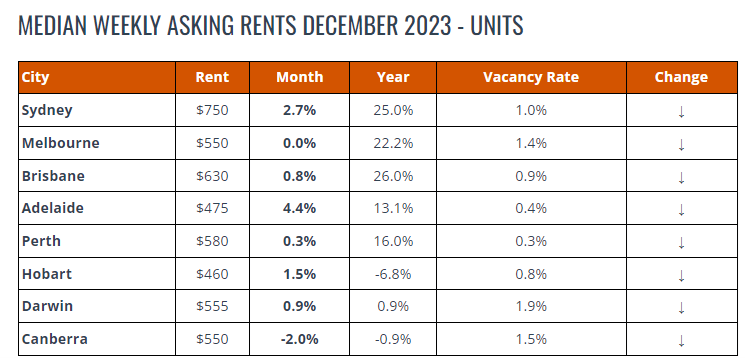

The Tight Rental Market: Opportunities for Investors

Australia currently faces a severe rental crisis, with rentals growing at double-digit rates and vacancy rates at historic lows.

Cities like Brisbane, Adelaide and Perth have seen sharp increases in weekly house rents. This situation, while challenging for renters, presents lucrative opportunities for property investors.

Some of our clients, for instance, have achieved close to 25% growth in just a few years, capitalising on these market conditions.

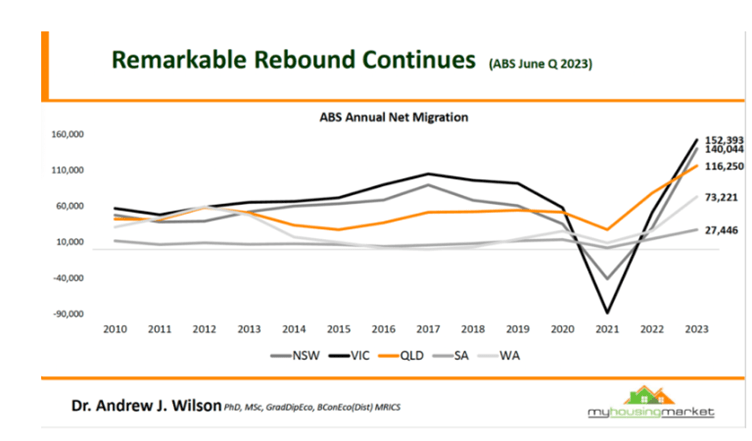

Australia’s Population Surge and Its Implications

The latest ABS figures reveal a dramatic increase in Australia’s population, reminiscent of the boom rates of the mid-1950s.

This surge, primarily driven by net overseas migration, has significant implications for the property market. The influx of over half a million foreign students, workers, and settlers necessitate increased accommodation, services, infrastructure, and schools.

This, juxtaposed against the current slump in new dwelling construction, suggests a tightening property market with increasing demand.

Strategizing for 2024

As we navigate through 2024, it’s not about rushing into property investments but about thoughtful planning and collaboration with professionals.

Defining long-term goals and formulating a robust property strategy are crucial steps towards financial success.

This is a promising year for property investors, and it is essential to take proactive steps towards realizing your financial ambitions.

For those seeking to explore these opportunities, my expertise is readily available. Don’t let 2024 pass without making strategic moves towards building substantial wealth.

Book your free call today here : https://app.acuityscheduling.com/schedule.php?owner=15351541&appointmentType=6007346