As we embrace 2024, it’s clear we’re not just starting a new year, we’re racing into an era of exceptional potential. 🚀

Typically, January is a slow month, a time for easing back into routines and holding off on significant decisions. Not this year.

The early days of 2024 have been anything but typical. There’s a palpable energy, with people quickly seizing the unique opportunities this year has already begun to unveil, and today I’m going to discuss the four reasons why the market is ripe, and for property investors, the time is now.

Unprecedented Population Growth

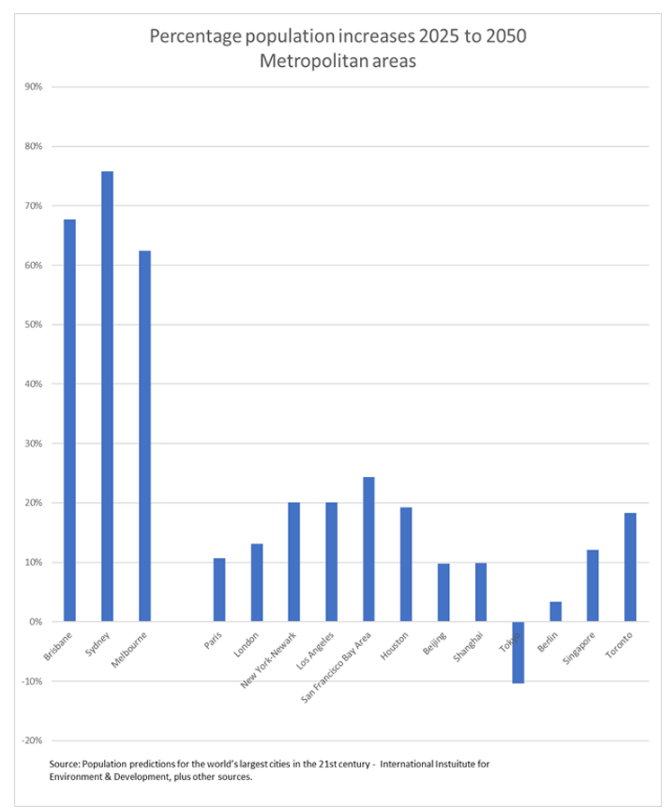

Australia’s population growth is a key driver in the rising demand for housing, and the latest figures for 2024 underscore this impact.

With a total population increase of 2.4% and significant gains in states like Queensland and Western Australia, we’re observing a direct correlation to the housing market’s buoyancy.

The influx of 518,100 people from overseas migration, led by arrivals on temporary visas such as international students, has injected vitality into our cities. While the cycle of arrivals and departures hasn’t yet normalised post-pandemic, the effect on urban housing demand is evident.

Natural increase, although lower than in previous years, combined with a resurgence of capital city living, has further constricted supply in capital cities.

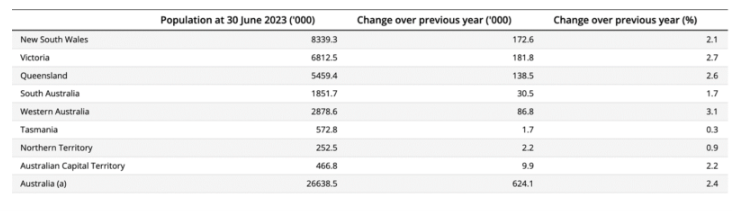

The provided graph showcases projected population increases in metropolitan areas from 2025 to 2050.

Brisbane rates amongst the fastest-growing cities in the world with comparable growth among the megacities like Sydney and Melbourne and even international hubs like Paris and London.

This projected surge in Brisbane’s population could signal a burgeoning demand for housing and services, presenting potentially lucrative opportunities for property investors.

Additionally, Australia’s recent milestone of reaching a population of 27 million nearly three decades earlier than predictions from 2002 illustrates the country’s rapid growth trajectory.

Such a substantial and swift increase in population can significantly strain housing markets, potentially leading to higher property values due to increased demand.

This context makes Australia, particularly cities like Brisbane, Adelaide and Perth with high growth projections and relative affordability, prime targets for property investment.

On the Cusp of a Property Market Surge

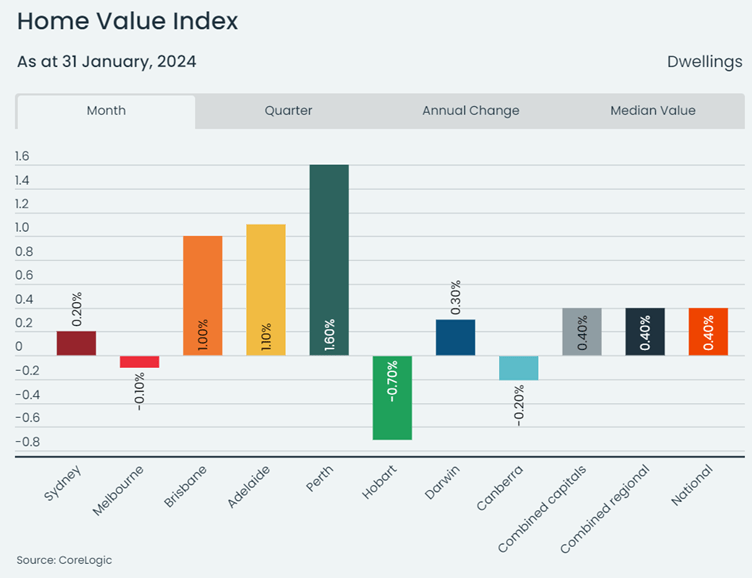

Understanding the ebbs and flows of the property market is key to timing your investment—and right now, we’re on the verge of a significant upswing. The current steady growth we’re witnessing is just the prelude to what I believe could be an exponential leap in property values.

The early indicators for 2024 are pointing to Adelaide, Brisbane, and Perth as frontrunners in this race, each showing strong growth signals. If these cities maintain their current trajectory, we could see annual growth rates surpassing 12% by year’s end.

In my years of experience, I liken this phase to the moment just before a kettle reaches boiling point—it’s the critical juncture before the market erupts into a frenzy driven by the fear of missing out. The smart move? To invest now, right before we hit this inflexion point, focusing on the cream of the crop properties that are poised to benefit most from the impending boom.

Rental Market Tightens Across Australian Capitals

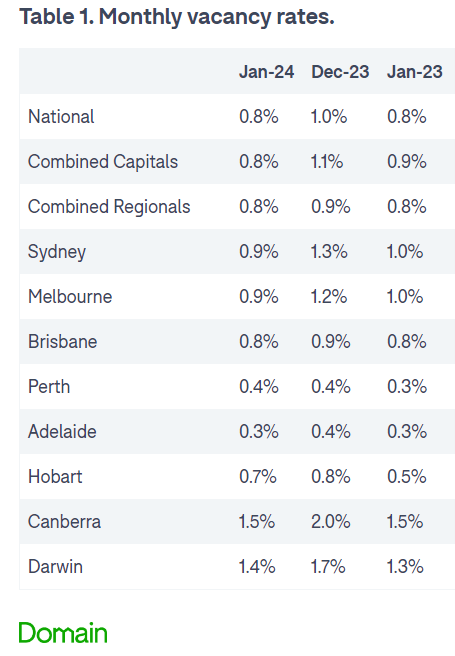

As rental properties in sought-after Australian suburbs become scarcer, competition among tenants intensifies, leading to a spike in rental prices. Our clients at Safe As 3 Houses have witnessed remarkable growth in weekly rental amounts over the last three years on their portfolio.

Sydney

In Sydney, the vacancy rate has dipped to a record low, with rental supply hitting its lowest point in January.

Melbourne

Melbourne also echoes this pattern, nearly matching its record-low vacancy rate amidst a seasonally driven dip in available rentals.

Brisbane

Brisbane’s vacancy rate decline, its first since September, points to fewer available rentals and heightened interest per listing.

Perth

Perth maintains a steady yet tight market with a pressing need for increased rental stock.

Adelaide

Adelaide presents the most challenging landscape for renters, with vacancy rates inching close to historic lows, amplifying the need for more rental properties.

With predictions of falling interest rates and high rental yields, the upcoming period may offer a prime opportunity for investors, potentially leading to reduced loan repayments and increased profitability in 2024.

A Reduction in Interest Rates

The final piece of the puzzle for ideal market conditions is on the horizon—a potential reduction in interest rates, which many anticipate could occur in 2024. The Reserve Bank of Australia has already set the stage with stable rates at the year’s commencement, and the buzz amongst experts points to a possible decrease around August. This timeline suggests that for investors, the moment to act is swiftly approaching if they aim to capitalize fully on their investment potential.

The impact of an interest rate decline is profound. Lower interest rates mean enhanced affordability, broadening the pool of potential homebuyers. This, in turn, increases demand—as mortgage servicing costs decrease, more people are financially empowered to enter the market. This sequence of events—more buyers and fewer available properties—naturally drives up property prices.

Make it a year of ‘I DID”

As we stand on the brink of a transformative era in Australian real estate, the insights from 2024 illuminate a path ripe with opportunity. The surge in population, a tightening rental market, and the prospect of falling interest rates converge to create a landscape abundant with potential for the astute investor. This isn’t just a time of change—it’s a time of unprecedented possibility.

Embrace the momentum, recognise the signs, and act.

The current climate is more than a fleeting chance; it’s the groundwork for lasting wealth and prosperity.

Don’t look back on 2024 as the year of ‘what if’—make it your year of ‘I did.’ Seize the moment, and let’s chart your course to success together.

Book your free appointment with today here for a no obligation chat : https://app.acuityscheduling.com/schedule.php?owner=15351541&appointmentType=6007346